Who is Ramit Sethi ?

Ramit Sethi, born on June 30, 1982, has become a household name in the personal finance world. He is the author of the bestselling book “I Will Teach You to Be Rich” and the creator of a popular blog by the same name. Sethi’s straightforward, actionable advice has made him one of the most trusted voices in personal finance.

His philosophy revolves around helping people achieve financial freedom, not through frugality, but by investing in what truly matters to them.

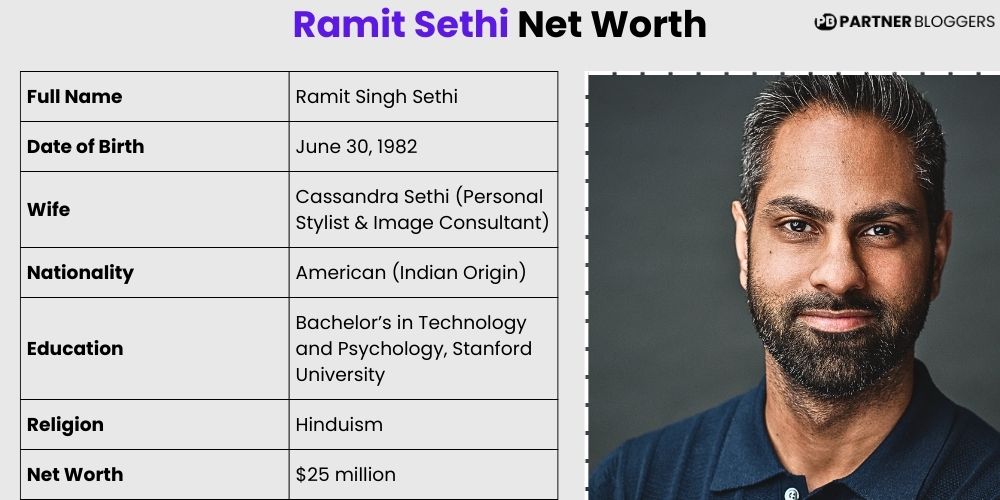

| Aspect | Details |

|---|---|

| Full Name | Ramit Singh Sethi |

| Date of Birth | June 30, 1982 |

| Wife | Cassandra Sethi (Personal Stylist & Image Consultant) |

| Nationality | American (Indian Origin) |

| Education | Bachelor’s in Technology and Psychology, Stanford University |

| Religion | Hinduism |

| Net Worth | $25 million |

Ramit Sethi’s Net Worth in 2024

As of 2024, Ramit Sethi’s net worth is estimated to be around $25 million. This wealth has been built over years through a combination of book sales, online courses, speaking engagements, and strategic investments.

Ramit’s flagship book, “I Will Teach You to Be Rich,” first published in 2009, has sold millions of copies worldwide. The book is a comprehensive guide to personal finance, covering topics such as saving, investing, and managing credit.

Read More : Christopher Yuan Net Worth

It has been praised for its practical advice and easy-to-follow steps. The success of this book significantly contributed to Ramit’s wealth, but it is far from his only income source.

| Year | Estimated Net Worth |

|---|---|

| 2015 | $5 Million |

| 2016 | $7 Million |

| 2017 | $10 Million |

| 2018 | $13 Million |

| 2019 | $16 Million |

| 2020 | $18 Million |

| 2021 | $20 Million |

| 2022 | $22 Million |

| 2023 | $24 Million |

| 2024 | $25 Million |

In addition to book sales, Ramit offers online courses that cover a wide range of topics from personal finance to entrepreneurship and personal development. His courses are priced between $100 and $12,000, depending on the content and length, and have attracted thousands of students globally. These courses have become a substantial part of his income stream, providing significant recurring revenue.

Beyond his educational ventures, Ramit is also an investor. Although he hasn’t disclosed his entire portfolio publicly, he has mentioned in interviews that he invests in real estate and the stock market.

Read More : Eddie Bravo Net Worth

His investment strategy is long-term, focusing on diversified portfolios that minimize risk while ensuring steady growth.

Ramit’s approach to building wealth is not just about accumulating money; it’s about living a rich life, which includes spending on things that bring joy and value. This philosophy resonates with his audience, making him a beloved figure in the personal finance community.

Ramit Sethi Net Worth Calculator

A net worth calculator is a tool designed to estimate an individual’s total net worth by aggregating various financial data points. For Ramit Sethi, this would involve the following steps:

- Income Sources: Input data on all sources of income, such as earnings from books, courses, investments, speaking engagements, and other ventures.

- Assets: List all significant assets, including savings, real estate holdings, investments, and any valuable personal items.

- Liabilities: Include any outstanding debts or financial obligations, such as loans, mortgages, or credit card balances.

- Calculate Net Worth: The formula to calculate net worth is:

- Adjustments: Adjust for any recent financial changes or future expectations that might impact the net worth.

Example Calculation for Ramit Sethi

If you have the following data:

The calculation would be:

This example provides a simplified view. For a more accurate assessment, consider including up-to-date financial data and possibly using professional tools or consulting financial experts.

Read More : Jamie Vernon Net Worth

Ramit Sethi’s Personal Life

Ramit Sethi’s personal life has played a crucial role in shaping his financial philosophies.

Ramit Sethi’s Wife:

Ramit is married to Cassandra Sethi, a professional personal stylist and image consultant. Cassandra has her own successful career and business, and the couple often collaborates on various projects.

They share a strong partnership, both personally and professionally, and their relationship is a testament to the power of mutual support and shared values.

Ramit Sethi’s Parents:

Ramit’s parents immigrated to the United States from India in search of better opportunities. His father worked as an engineer, and his mother was a teacher. Growing up in a middle-class household, Ramit was taught the importance of education and hard work from an early age.

His parents instilled in him the value of financial independence, which became the foundation for his career in personal finance. Ramit often credits his parents for his success, particularly their emphasis on education and self-discipline.

Ramit Sethi’s social media presence along with the respective links:

| Platform | Username/Handle | Link |

|---|---|---|

| @ramit | ||

| @ramit | ||

| Ramit Sethi | ||

| YouTube | Ramit Sethi | YouTube |

| Ramit Sethi | ||

| Website/Blog | I Will Teach You to Be Rich | Website |

Ramit Sethi’s Car Collection:

Unlike many millionaires, Ramit Sethi doesn’t flaunt a flashy car collection. He believes in spending on things that bring joy, and for him, that doesn’t necessarily mean expensive cars. Ramit owns a modest collection, including practical vehicles that serve his needs without being overly extravagant.

His philosophy is that money should be spent on experiences and things that add real value to life, rather than on status symbols.

Read More : Shakib Al Hasan Net Worth

Ramit Sethi’s Monthly Salary

Estimating Ramit Sethi’s exact monthly salary can be challenging due to the variety of his income streams. However, it is believed that he earns around $200,000 per month. This figure includes income from his book royalties, online courses, investments, and other ventures.

- Book Royalties: Ramit continues to earn significant royalties from “I Will Teach You to Be Rich,” which has been updated and re-released multiple times. The book’s consistent sales contribute a steady stream of income each month.

- Online Courses: Ramit’s courses, such as “Earnable” and “Find Your Dream Job,” are among the most popular and lucrative. With prices ranging from a few hundred to several thousand dollars, these courses bring in substantial revenue. Given the scale of his audience, it’s easy to see how his monthly earnings reach the six-figure mark.

- Investments: Ramit’s investment portfolio also generates passive income. While the exact figures are unknown, he has spoken about investing in index funds, real estate, and other vehicles that provide steady returns.

This diversified income strategy not only boosts his wealth but also aligns with his philosophy of financial independence. Ramit often emphasizes that relying on a single income source is risky and encourages others to build multiple streams of revenue.

Ramit Sethi’s Money Rules

10 Inspiring Lessons from Ramit Sethi’s Life

Ramit Sethi’s life and career are filled with valuable lessons that can inspire anyone looking to improve their financial situation. Here are ten key takeaways:

1-Dream Big and Reflect:

Ramit encourages people to think big when it comes to their financial goals. By reflecting on past financial decisions and learning from them, you can create a richer future. He suggests taking the time to dream about what you really want and then planning how to achieve it.

Read More :Manu Bhaker Net Worth

2-Align Spending with Vision:

According to Ramit, your spending should align with your life goals. This principle is at the core of his “Conscious Spending Plan,” which helps people prioritize their expenses to support their dreams rather than wasting money on things that don’t matter.

3-Negotiate Everything:

One of the most effective yet underutilized strategies Ramit advocates is negotiation. Whether it’s lowering your credit card interest rate or negotiating your salary, small changes can add up to significant savings. Ramit advice has helped thousands of people save money by simply asking for better terms.

4-Use Credit Wisely:

Ramit stresses the importance of managing credit responsibly. While credit cards can offer rewards and benefits, they can also lead to debt if not used wisely. Ramit advises paying off balances in full each month to avoid interest charges and maintain financial health.

5-Increase Earnings:

While saving is important, Ramit emphasizes the limitless potential of earning more. Whether it’s through a raise, a side hustle, or a new job, increasing your income can have a far greater impact on your financial situation than cutting costs. This proactive approach to wealth-building is central to his philosophy.

6-Invest in What You Love:

Ramit is a big believer in spending on things that truly matter to you. Whether it’s travel, dining out, or investing in hobbies, he encourages people to use their money to enhance their quality of life. This doesn’t mean reckless spending but rather intentional, value-driven financial decisions.

7-Financial Education is Key:

From a young age, Ramit understood the importance of financial education. His passion for learning about money management led to his success, and he continues to stress the importance of financial literacy in achieving wealth.

8-Automation is Power:

Automating savings and investments is one of Ramit’s top recommendations. By setting up automatic transfers to savings or investment accounts, you ensure that your wealth grows consistently without having to think about it.

9-Give Back:

Ramit believes that wealth should be shared. He regularly donates to causes he cares about and encourages others to do the same. Giving back not only helps those in need but also adds a sense of purpose and fulfillment to your financial journey.

10-Focus on the Big Wins:

Instead of getting bogged down by minor expenses, Ramit advises focusing on the big financial decisions that can have a significant impact on your life. This includes negotiating your salary, investing wisely, and making smart purchasing decisions. By concentrating on these “big wins,” you can achieve financial success more efficiently.

Read More : Neeraj Chopra Net Worth

Conclusion

Ramit Sethi’s journey from the son of Indian immigrants to a multimillionaire and financial guru is truly inspiring. His straightforward approach to personal finance has empowered millions to live richer lives. Through his book “I Will Teach You to Be Rich” and online courses, he has become a leading figure in personal finance.

Ramit’s success, with a net worth of $25 million, highlights the power of education, hard work, and strategic financial planning. His teachings have helped countless people achieve financial independence, making his influence both far-reaching and impactful.